Introduction

“Do trading bots really make money?”

It’s one of the most searched—and misunderstood—questions in modern trading.

In 2025, automation is no longer a futuristic concept. Tools are smarter, data is cheaper, and creating a trading strategy isn’t limited to programmers anymore.

But the truth is nuanced. Some bots do make money. Most don’t.

The difference lies not in luck, but in logic.

In this article, we’ll break down why most bots fail, what makes others succeed, and share real examples from the AlgoBuilderX community, where traders build, test, and even pass prop firm challenges using their own automated systems.

Why Most Trading Bots Don’t Work

Let’s start with reality: most off-the-shelf trading bots fail. Not because automation itself is broken—but because of how those bots are built and used.

The three main reasons are:

- Overfitting – Bots are often tuned to look perfect on past data, but collapse when real conditions change.

- Static assumptions – Fixed take profits, stops, or RSI thresholds that ignore volatility or market regime.

- Black box syndrome – Traders buy or download bots they don’t understand, then can’t fix or optimize them.

These are not flaws of automation—they’re flaws of process. Successful automation comes from iteration, transparency, and control.

Why Some Trading Bots Actually Work

Bots that survive the test of time share a few defining traits:

- Awareness of volatility and market regimes. A bot that “knows when not to trade” usually outlives one that trades 24/7.

- Forward testing and real-world validation. The best builders treat backtests as filters, not guarantees.

- Iteration over perfection. Every profitable system has versions. Each refinement is data-driven, not emotional.

Automation that’s designed this way isn’t “set and forget”—it’s build, test, learn, repeat.

Real Traders, Real Results: Inside the AlgoBuilderX Community

Inside the AlgoBuilderX Discord, the #backtest-results channel has become a showcase of real performance:

equity curves, consistent backtests, live tests, and discussions between traders refining their bots together.

One particular story stands out.

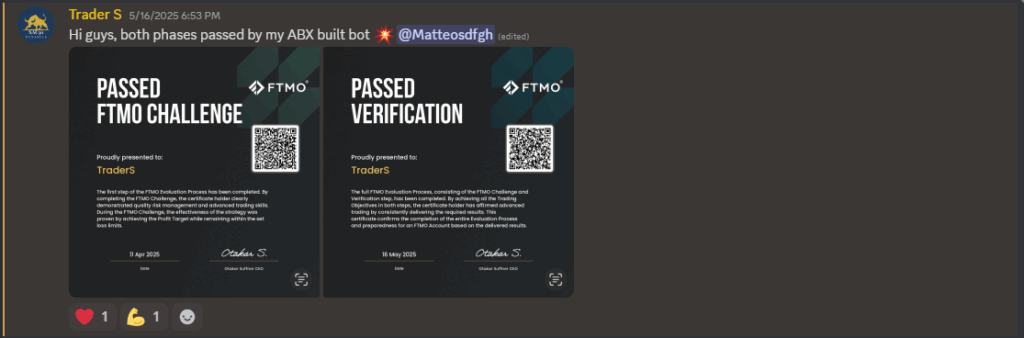

A member of the community has successfully passed multiple FTMO Challenges using bots built entirely inside AlgoBuilderX.

The achievement isn’t about luck—it’s about process: clear entry logic, adaptive conditions, strict risk management, and patience.

You can read the full interview here → TraderS: How I passed the FTMO Challenge in 24 days with a bot created on AlgoBuilderX (Q&A Case Study)

💬 “The biggest lesson was simple but powerful: trust the process and don’t interfere. Almost every time I stepped in, it hurt the results. Learning to stay disciplined and let the bot do what it was built to do has been a game changer..”

-TraderS

These authentic examples matter because they show that automation isn’t fantasy. It’s craft.

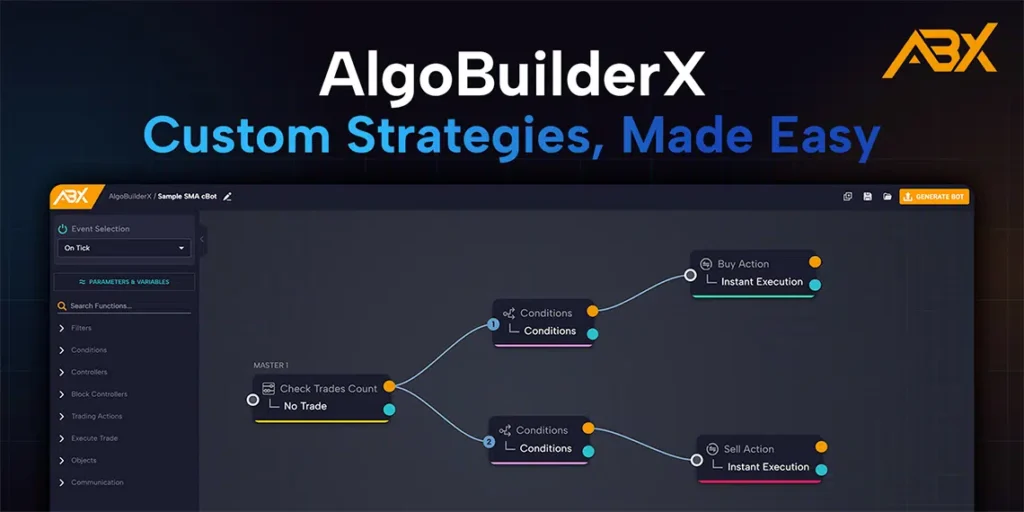

The Power of No-Code Automation

Two years ago, your only choices were to code in MQL or C#… or buy someone else’s bot.

Now, platforms like AlgoBuilderX have removed that barrier completely.

With a visual drag-and-drop builder, you can:

- Combine indicators and filters logically

- Design strategies step-by-step

- Export directly to cTrader Automate (.algo) format

- Run, test, and refine—without touching a single line of code

This shift means traders can focus on strategy logic instead of programming syntax.

No-code automation lets you experiment faster, learn faster, and improve faster.

What “Working” Really Looks Like

A working bot isn’t magic—it’s discipline, consistency, and alignment with the market.

It has losing days. It has losing streaks. But it behaves according to plan.

A real bot that works:

- Limits damage when volatility spikes

- Trades only in suitable sessions

- Protects capital first, profits second

If a bot promises constant profit, zero drawdown, or “guaranteed income,” it’s marketing, not trading

Where AlgoBuilderX Fits In

AlgoBuilderX was built to make this process accessible.

You can design logic visually, test it directly in cTrader, and export it instantly.

And because it’s connected to an active Discord community, you’re never building in a vacuum.

You can see what others are doing, learn from their results, and contribute your own.

If you’re new and want to try it yourself, check out our full beginner guide → How to Create an Automated Trading Bot Without Coding (Step-by-Step Guide 2025)

The FTMO Connection

Prop firm challenges like FTMO attract traders because they offer access to significant trading capital under strict risk rules.

Passing them with an automated strategy isn’t easy — it demands stability, consistency, and precise risk discipline.

That’s exactly why AlgoBuilderX partnered officially with FTMO, creating a bridge between traders who use automation and one of the most respected prop firms in the world.

If you’ve already purchased an FTMO Challenge, you can access AlgoBuilderX with an exclusive 25% recurring discount — making it easier than ever to build, test, and refine your strategies before funding.

Read: Prop Firm FTMO Partners with cTrader Algo Building Tool

The Reality of Risk and the Long Game

Automation doesn’t eliminate risk—it organizes it.

You’ll still face market shifts, slippage, broker differences, and unexpected volatility.

But unlike emotional trading, bots execute with consistency, and that consistency makes improvement possible.

The compounding effect in automated trading doesn’t come from one perfect strategy—it comes from a thousand small refinements over time.

Conclusion

So, can you really make money with trading bots?

✅ Yes—but only if you treat them as systems, not shortcuts.

Trading bots work when:

- The logic makes sense,

- The data is honest,

- The risk is controlled, and

- The process never stops evolving.

That’s exactly the philosophy behind AlgoBuilderX and its growing community of traders building smarter, data-driven automation every day.

👉 Join the AlgoBuilderX Discord, check the #backtest-results channel, and see how real people are building and improving their bots.

And if you’re ready to build your first one—without coding—start here: How to Create an Automated Trading Bot Without Coding

FAQ

Do trading bots really work?

They can. The key is transparency, testing, and risk control—not magic formulas.

Is backtesting enough?

No. Backtesting validates ideas; forward testing proves durability.

Can I pass a prop challenge with a bot?

Yes—some ABX members have done it. But your bot must follow the rules to the letter.

Do I need coding skills?

Not anymore. With AlgoBuilderX, you can build complex bots for cTrader using only visual logic.