Introduction — Passing FTMO Is Not About Being “Good at Trading”

Every month, thousands of traders start an FTMO Challenge convinced that this time will be different.

They’ve refined their strategy, adjusted their risk, maybe even followed a new mentor.

And yet, the outcome is almost always the same: failure.

Not because FTMO is a scam.

Not because the rules are impossible.

But because most traders approach FTMO in the worst possible way.

Passing an FTMO Challenge is not about predicting the market better.

It’s about executing consistently under strict rules, without emotional interference.

And that’s where the difference between failing traders and successful ones really shows.

Why Most Traders Fail FTMO Challenges

Let’s be honest.

FTMO doesn’t eliminate bad traders — it exposes behavioral weaknesses.

The most common reasons for failure are always the same:

- Overtrading after a loss

- Revenge trading

- Violating daily drawdown rules by “just one more trade”

- Increasing risk to recover faster

- Ignoring session discipline

- Interfering manually with trades

Ironically, many of these traders have strategies that work on paper.

They fail not because their logic is wrong, but because they cannot execute it with discipline.

FTMO doesn’t reward intelligence.

It rewards consistency.

What Successful FTMO Traders Do Differently

When you analyze traders who consistently pass FTMO challenges, a clear pattern emerges.

They don’t:

- trade all day

- chase every setup

- increase size emotionally

- override their rules

Instead, they focus on:

- strict risk per trade

- limited number of daily trades

- predefined trading sessions

- accepting missed opportunities

- protecting capital before chasing profit

In short, they behave like systems, not like humans.

And this is where automation becomes extremely relevant.

Why Automation Fits FTMO Better Than Manual Trading

FTMO’s rules are perfectly compatible with algorithmic trading:

- Fixed daily loss limits

- Fixed max loss limits

- Clearly defined profit targets

- Time-based trading windows

- Risk constraints

All of these are easy to encode in logic — and very hard to respect emotionally.

Manual traders break FTMO rules not because they want to, but because they’re human.

Automated systems don’t feel:

- fear

- frustration

- boredom

- overconfidence

They execute exactly what they’re told. Nothing more.

That’s why disciplined automation has quietly become one of the most effective approaches for prop firm challenges.

Real Case: FTMO Challenges Passed With Automated Strategies

Inside the AlgoBuilderX community, several traders openly share their backtests, live results, and challenge outcomes in the #backtest-results channel.

One experienced trader, with over a decade of market exposure, has passed multiple FTMO challenges (TraderS: How I passed the FTMO Challenge in 24 days with a bot created on AlgoBuilderX) using a fully automated system built entirely with AlgoBuilderX.

What’s important here is not the numbers — it’s the process.

His system:

- respects strict daily loss limits

- caps the number of trades per day

- trades only during specific sessions

- uses structured, multi-condition logic

- avoids martingale and grid behavior

- prioritizes capital preservation over aggressive growth

This is not luck.

This is engineering discipline.

The FTMO Challenge From an Algorithmic Perspective

From a purely technical standpoint, FTMO challenges are not hard.

They are rigid — and rigidity is exactly what algorithms are good at.

An automated FTMO-ready strategy typically includes:

- hard daily loss protection

- hard max loss protection

- session filters

- trade count limits

- fixed risk per trade

- automatic stop conditions after profit target

These rules are easy to define logically — but extremely hard to respect manually during drawdowns.

This is where automation stops being a “nice-to-have” and becomes a competitive advantage.

Manual Trading vs Automated Trading on FTMO

Let’s be clear.

Manual trading can work on FTMO — but only for traders with:

- exceptional discipline

- emotional control

- patience

- and years of experience

Automation doesn’t make you profitable.

But it forces discipline, which is exactly what FTMO demands.

FTMO is not about brilliance.

It’s about not breaking the rules.

Automation helps with that more than any indicator ever will.

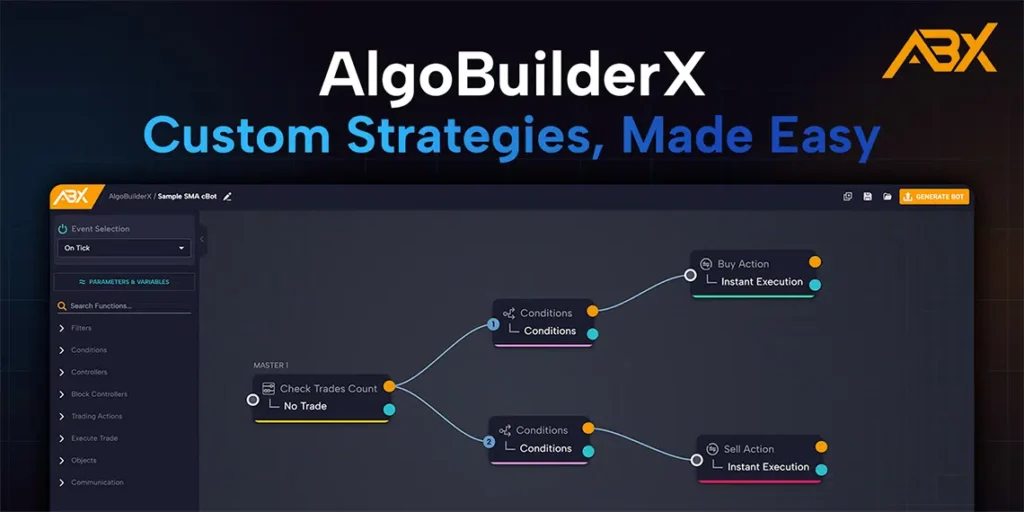

Where AlgoBuilderX Fits Into the Picture

AlgoBuilderX exists precisely to solve this problem.

Most traders don’t fail FTMO because they lack ideas.

They fail because they cannot translate those ideas into disciplined execution.

AlgoBuilderX allows traders to:

- build FTMO-compliant strategies visually

- define risk rules once and enforce them automatically

- limit trades per session or per day

- stop trading after drawdown thresholds

- remove emotional overrides completely

All without writing code.

Instead of fighting C#, debugging errors, or relying on black-box EAs, traders can see their logic, control it, and refine it.

This doesn’t guarantee success.

Nothing does.

But it removes the biggest reason traders fail FTMO: themselves.

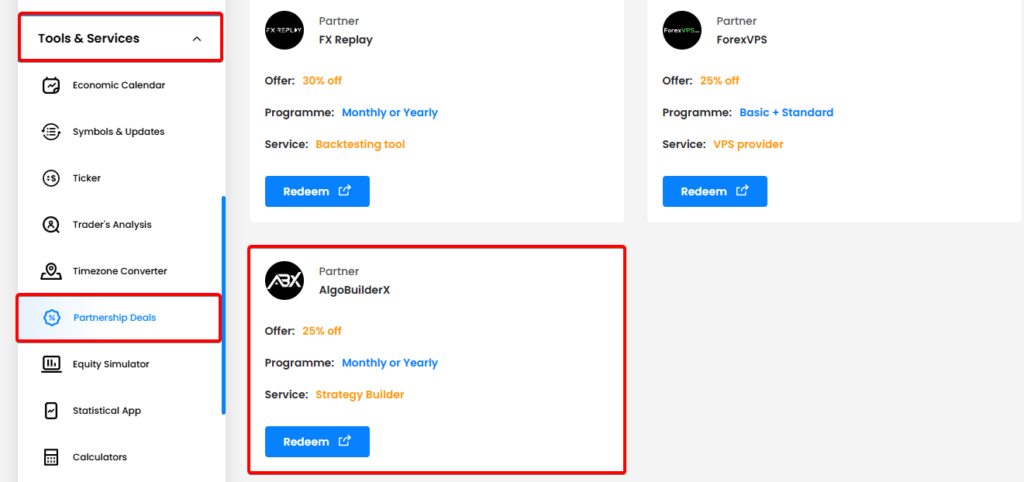

FTMO & AlgoBuilderX Partnership: A Concrete Advantage for FTMO Traders

There’s an important detail many traders don’t realize.

FTMO and AlgoBuilderX are official partners.

For traders who have already purchased an FTMO Challenge, this partnership provides a very concrete benefit.

Inside the FTMO User Dashboard, under Tools & Services → Partnership Deals, eligible users can access AlgoBuilderX directly and register with a 25% lifetime discount on all AlgoBuilderX plans.

This isn’t a temporary promotion or a one-time coupon.

It’s a recurring lifetime discount, designed specifically for FTMO traders who want to improve their execution, structure, and discipline.

Why does this partnership make sense?

Because FTMO challenges reward:

- strict risk control

- consistent execution

- rule-based trading

- emotional neutrality

And AlgoBuilderX is built precisely to help traders enforce those principles through automation and structured logic.

For FTMO traders who already understand the challenge environment, this partnership lowers the barrier to adopting a more disciplined, systematic approach — without needing to learn programming or rely on opaque third-party bots.

It’s not a shortcut.

It’s a structural advantage.

Final Thoughts — FTMO Is a Discipline Test, Not a Skill Test

If you’re failing FTMO challenges repeatedly, the problem is rarely your strategy.

More often, it’s:

- inconsistency

- emotional execution

- rule violations

- lack of structure

FTMO rewards traders who think like systems.

Whether you choose to trade manually or automate, the takeaway is simple:

If your execution is not consistent, FTMO will punish you.

Tools like AlgoBuilderX don’t pass challenges for you.

But they give you the structure, discipline, and control that FTMO silently demands.

And in prop firm trading, discipline is everything.